The digital currency markets are again making gains, moving from the lows seen a few weeks ago. As the co-founder of 21st Paradigm explained, this week crypto traders are discussing over-the-counter (OTC) desks with demand for bitcoin, “high net worth individuals.” [and] Institutions want your bitcoin.”

Analyst Says Big Market Players ‘Want Your Bitcoin’

Most traders use either decentralized exchange (DX) platforms or centralized exchange (CEX) operations to obtain bitcoins.B T c) and myriad other digital currencies. However, high-net-worth individuals and institutions typically do not take advantage of DEX or CEX applications, as they choose to trade through over-the-counter (OTC) trading desks. OTC trading or off-exchange trading is trading between two parties directly and usually with the help of a representative of the OTC desk. Unlike trades that take place on the CEX or DEX platforms, these trades are not recorded in the order book. However, transfers from crypto OTC desks can be recorded.

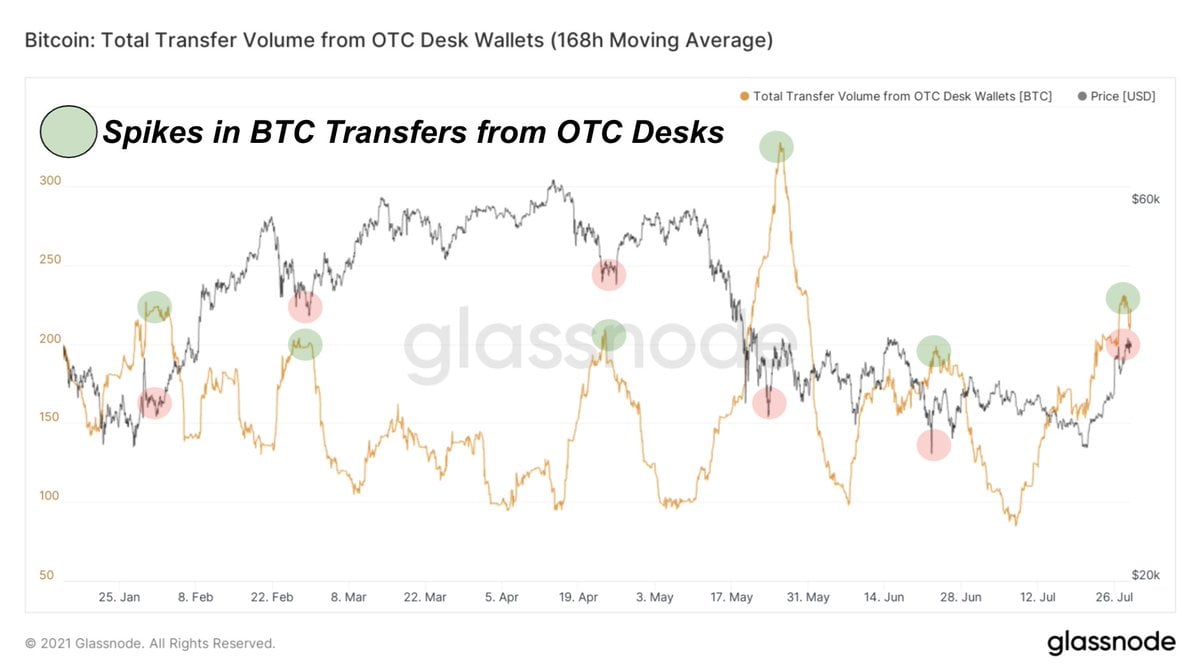

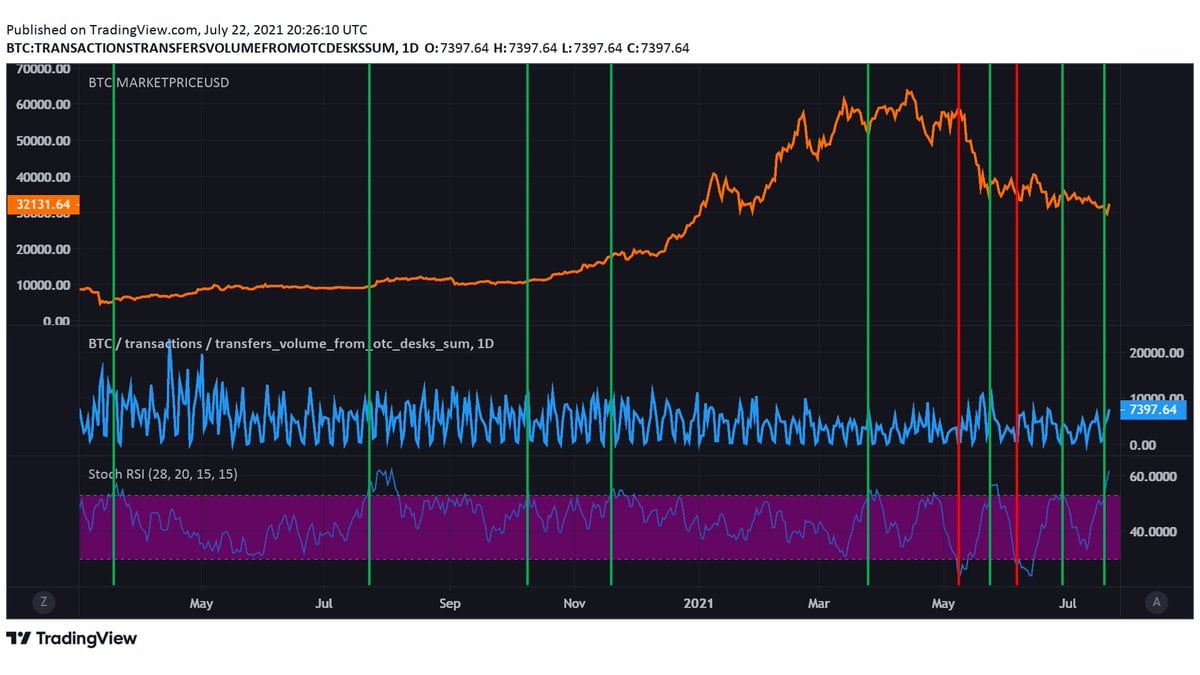

two days ago, co-founder of consulting firm 21st paradigm, dylan leclair, tweeted About some big OTC transfers last week by sharing charts from Glassnode Analytics. “Large transfer volume from the OTC desk last week,” LeClear said at the time. “high net worth individuals [and] Institutions want your bitcoins,” he said. Another person agreed with LeClaire and said “Yasssir,” because the person, Will Clemente, shared a tweet on July 22 that showed a similar trend.

“OTC outflow RSI is showing the strongest B T c Buy signals from July last year,” analyst Will Clemente Said for his 158,000 Twitter followers. “This indicates purchases from institutions/high-net-worth individuals,” he said. Many other traders discussing this topic on Twitter agree with the OTC demand assessment and the social media platform littered with threads discussing the topic. a person tweeted:

Noticeable Market Changes During China’s Morning Trading Session

Several other ‘whale-like’ and larger buying patterns were observed by bitcoiners. Overview of different metrics. While bitcoin is on the rise, traders are also skeptical that China may be buying bitcoin. According to Trustnode, there have been some significant changes in the early morning market in China Research.

Meanwhile, during the last 24 hours bitcoin (btc) Consolidated just above the handle of $41K and increased only +0.10% on Sunday, August 1. Although, B T c Still up 17% against the US Dollar over the past week and 30-day statistics show B T c an increase of over 22%. Bitcoin managed to jump from the handle of $42K to $42,615 per unit, but did not stay above the $42K area for long.

What do you think about Bitcoin OTC demand valuations from traders and analysts on social media? Let us know what you think about this topic in the comment section below.

image credit: Shutterstock, Pixabay, WikiCommons, Glassnode, Tradingview, Twitter, Will Clemente

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation or recommendation or endorsement of an offer to buy or sell any products, services, or companies. bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the Company nor the author is responsible, directly or indirectly, for any damage or loss alleged to be caused by or in connection with the use or reliance on any materials, goods or services mentioned in this article.

Just Bookmark For More Updates